what does cares act do

Introduction In the face of the economic and social disruption caused by the coronavirus Congress has passed three pieces of legislation aimed at combatting the virus and its impact. As soon as everything began shutting down in an effort to slow the spread of COVID-19 the economy started to take a big hit.

Cares Act Investment New Jersey State Library

17 rows The CARES Act was the first piece of coronavirus legislation to instate the forbearance and.

. Were not accounted for in the budget most recently approved as of March 27 2020 the date of enactment of the. The law was enacted in two parts. Until january 1 2021 employers can pay the employee or their lender for any principal or interest of a qualified education loan incurred by the employee for education of the.

The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large businesses. Depending on whether the property is single residential or multifamily. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

The comprehensive health care reform law enacted in March 2010 sometimes known as ACA PPACA or Obamacare. On March 27 Congress passed the Coronavirus Aid Relief and Economic Security CARES Act the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic. The law has 3 primary goals.

The CARES Act allocates 16 billion to replenish the Strategic National Stockpile supply of pharmaceuticals personal protective equipment and other medical supplies which are distributed to state and local health agencies hospitals and other healthcare entities facing shortages during emergencies. The CARES Act allocates about 150 billion in funds to enhance hospital capacity expand the strategic national stockpile of personal protective equipment support the public health efforts of the. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes.

But the CARES Act does much more than that. CARES Act What Property Owners and Landlords Should Know. The Coronavirus Aid Relief and Economic Security Act CARES Act programs offered a much-needed lifeline for many businesses in 2020.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. The Patient Protection and Affordable Care Act was signed into law on March 23 2010 and was amended by the Health Care and. While that is great news in and of itself heres a look at some of the key.

The CARES Act 401 k Withdrawal allows those with a 401 k plan to withdraw their funds for financial hardship reasons relative to the COVID-19 pandemic without being penalized. The CARES Act does not provide the same assistance to renters and ineligible homeowners who may be forced to rely on state and county assistance. What Is the CARES Act.

The CARES Act provides that the IRS will make automatic payments to individuals who have previously electronically filed their income tax returns using direct deposit banking information provided on a return any time after January 1 2018. The Affordable Care Act ACA is the name for the comprehensive health care reform law and its amendments. The CARES Act was signed into law on Friday March 27 2020.

This includes the requirement that the Federal Reserve Board. History and will allocate 22 trillion in support to individuals and businesses affected by the pandemic and economic downturn. The CARES Act requires that the payments from the Coronavirus Relief Fund only be used to cover expenses that.

Are necessary expenditures incurred due to the public health emergency concerning the Coronavirus Disease 2019 COVID19 and. If youve experienced a job loss pay cut falling revenue or other financial difficulties as a result of the coronavirus pandemic theres a good chance that the CARES Act can help. The law provides consumers with subsidies premium tax credits that lower costs for households with incomes between 100 and 400 of the federal poverty level FPL.

Even if you havent experienced a negative financial situation lately its still important to understand what. So President Trump signed the Coronavirus Aid Relief and Economic Security Act aka the CARES Act in March 2020 as a way to help keep Americans and businesses afloat as we ride out this pandemic. The District of Columbia and US.

Make affordable health insurance available to more people. The bill was signed into law on March 27 2020 by President Donald Trump. Territories consisting of the Commonwealth of Puerto Rico the United.

It also sets out how it can do so even if. The act provides access to retirement funds from 401 k plans. The cares act does not require the grant to be repaid even if the eidl applicant is denied.

The CARES Act temporarily suspends certain government oversight laws. The Act sets out when the local authority has a responsibility to meet someones care and support needs. Most provisions apply only to Direct Loans and Federal Family Education Loans FFEL loans currently owned by the US.

The law addresses health insurance coverage health care costs and preventive care. The Act contains several provisions which prevent eviction of residential tenants for a one-hundred twenty 120 day period. The CARES Act provides mortgage forbearance to any homeowner with a federally-backed mortgage.

During the pandemic your lender cannot deny your forbearance request nor can it demand proof of. Many people have questions about how the new law impacts their families and. What does the Care Act do.

Congresss latest coronavirus relief package the Coronavirus Aid Relief and Economic Security CARES Act is the largest economic relief bill in US. The CARES Act includes several provisions that apply to certain loans owed by some federal student loan borrowers. An additional 1 billion is allocated for the Defense Production.

The federal CARES Act was signed into law on Friday March 27 2020.

Essential But Undervalued Millions Of Health Care Workers Aren T Getting The Pay Or Respect They Deserve In The Covid 19 Pandemic

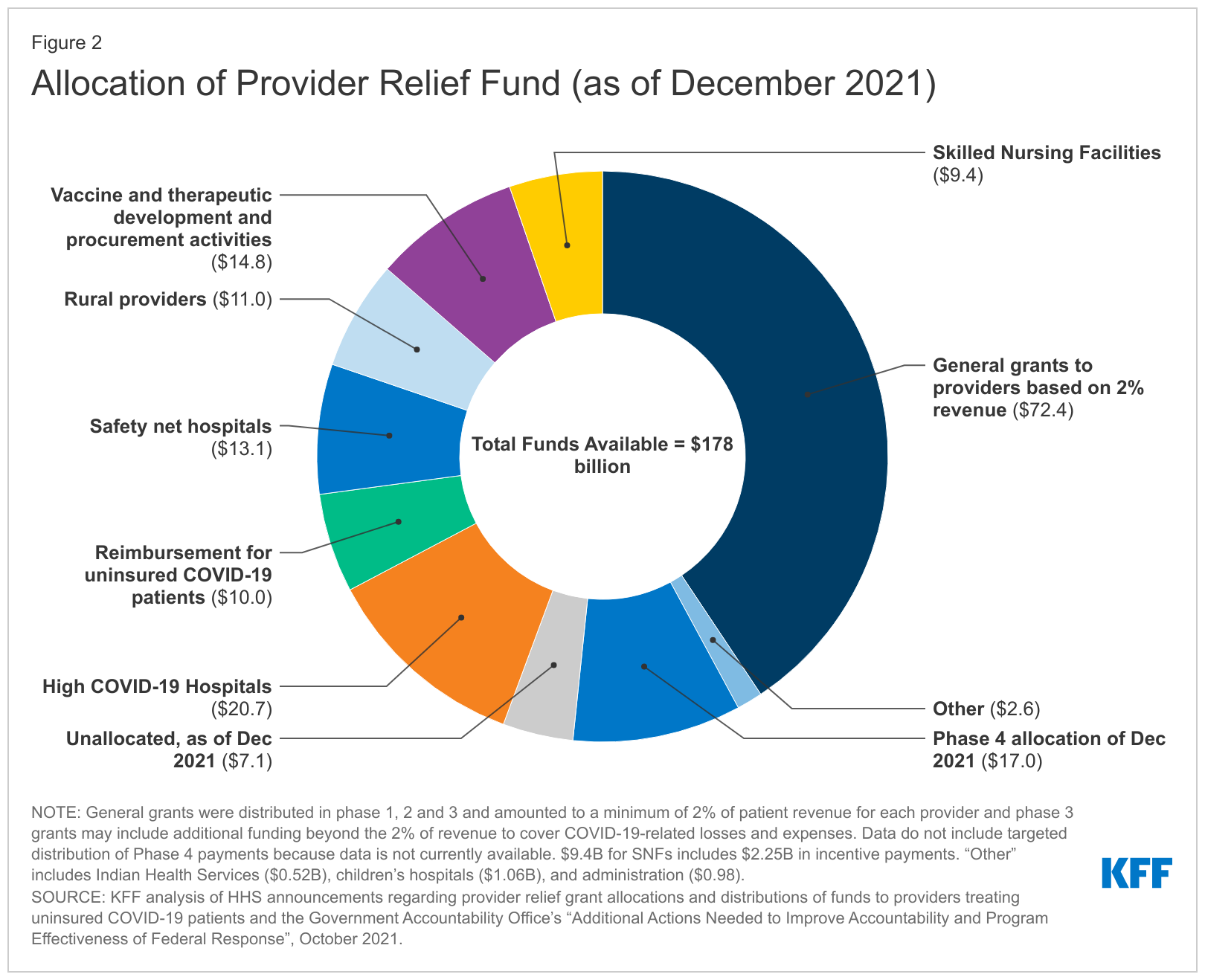

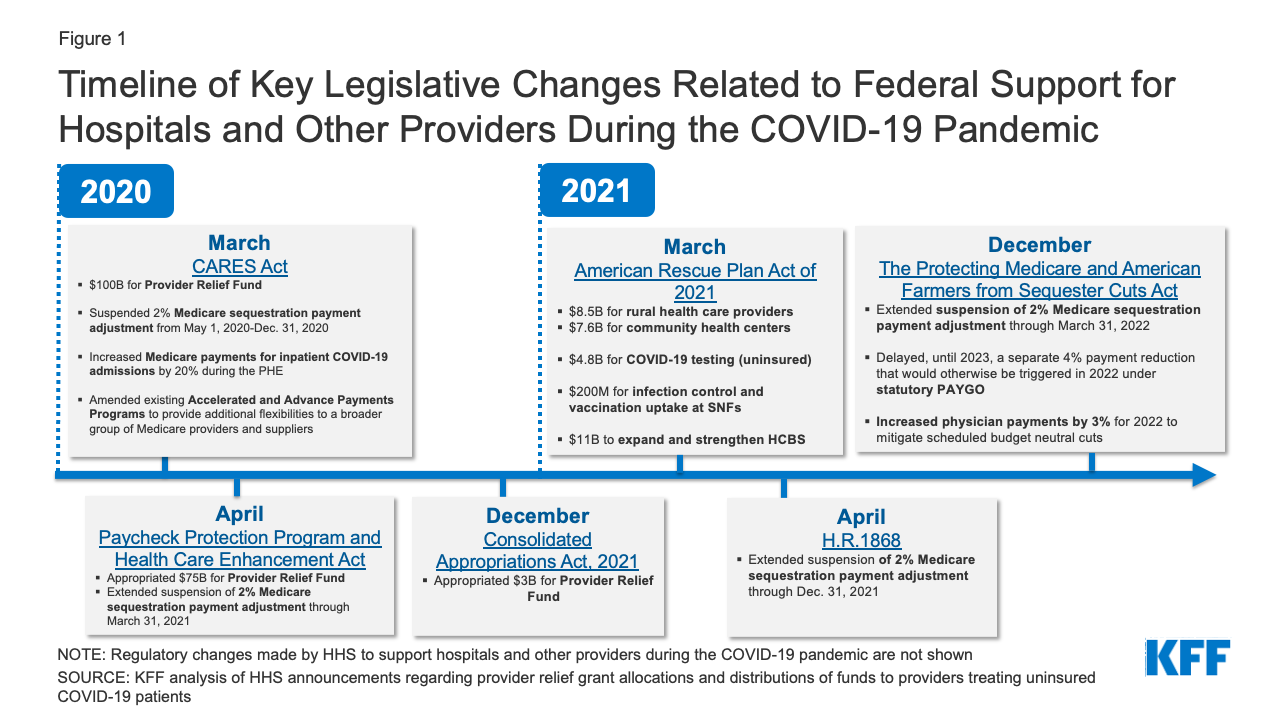

Funding For Health Care Providers During The Pandemic An Update Kff

/obamacare_taxes-51d679e83961433f838888af858e0692.jpg)

Affordable Care Act Aca Definition

Five Things To Know About The Cost Of Covid 19 Testing And Treatment Kff

Further Guidance On Covering At Home Tests For Covid 19 Health Affairs

![]()

Covid 19 Test Prices And Payment Policy Peterson Kff Health System Tracker

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

Funding For Health Care Providers During The Pandemic An Update Kff

Cares Act Policy Limestone University

Cares Act Faq Municode Powered By Civicplus

The Cares Act Has Passed Here Are The Highlights

Details Of The Coronavirus Relief Bill The Cares Act Npr

Key Economic Findings About Covid 19 Bfi

The Coronavirus Aid Relief And Economic Security Act Summary Of Key Health Provisions Kff

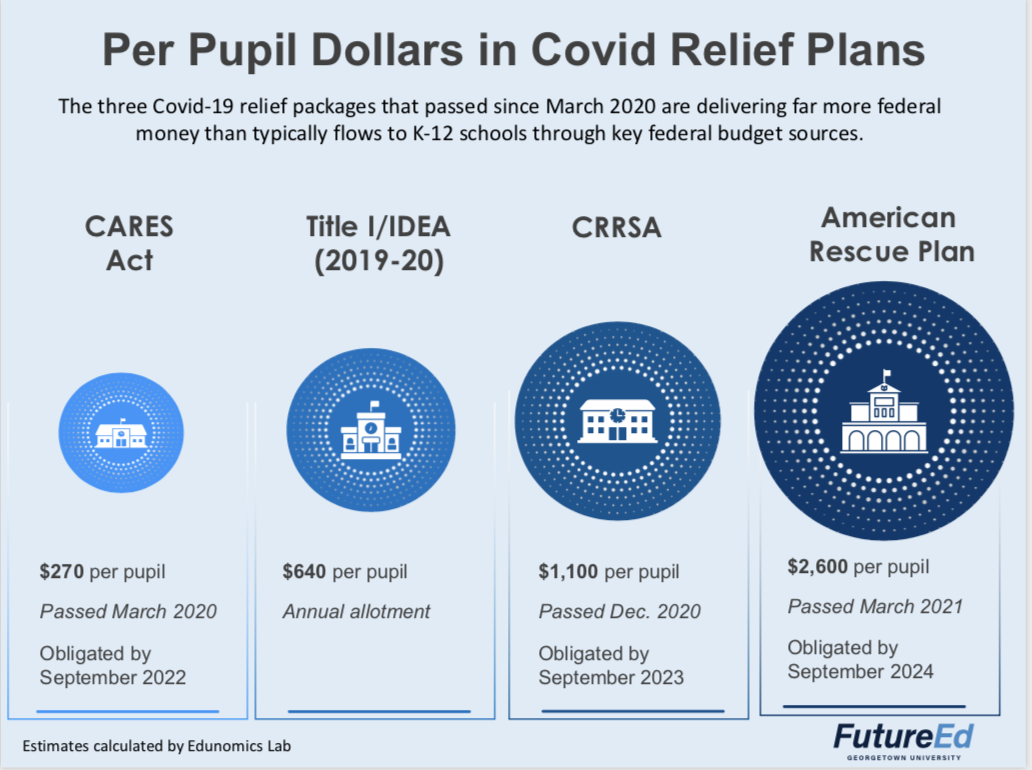

What Congressional Funding Means For K 12 Schools Futureed

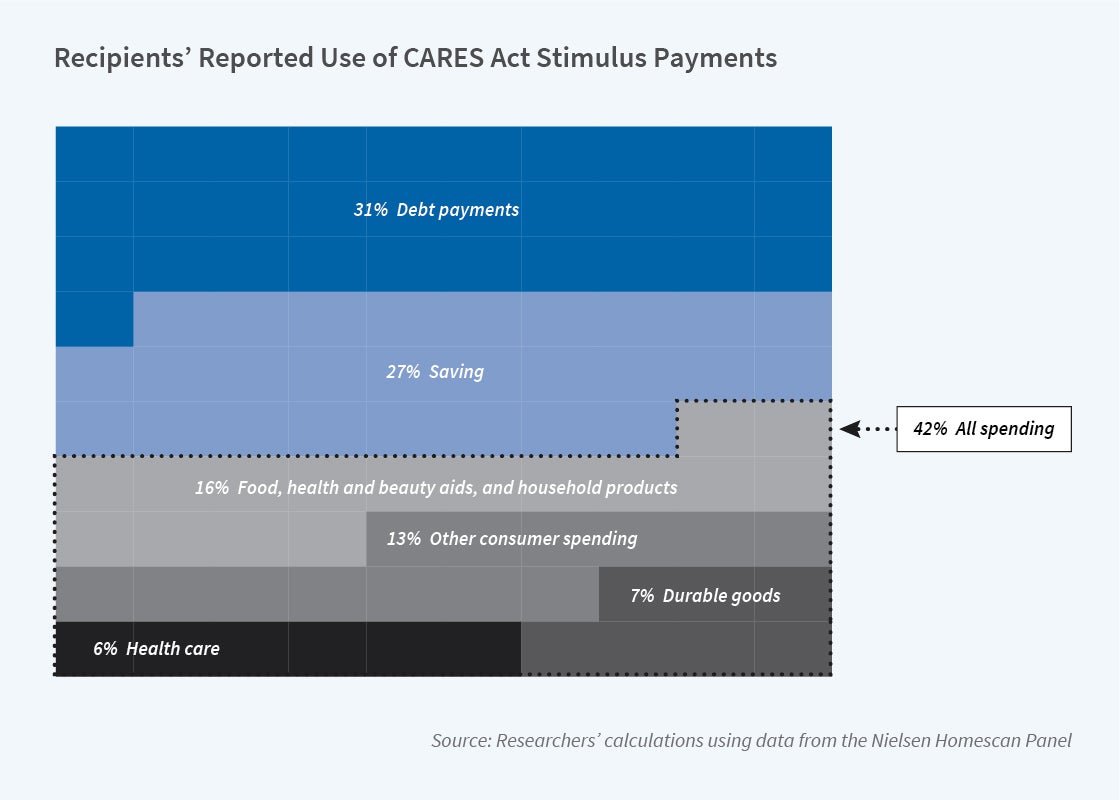

Most Stimulus Payments Were Saved Or Applied To Debt Nber

Affordable Care Act In California Health For California

Nonresident Guide To Cares Act Stimulus Checks

How Did Americans Use Their Coronavirus Stimulus Cheques The Economist